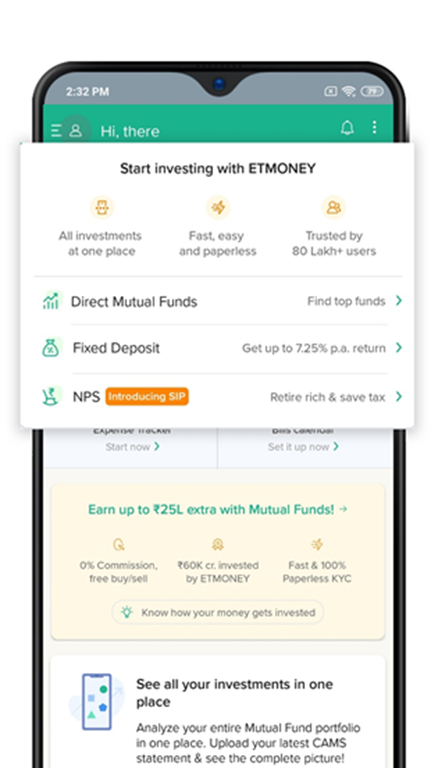

Everyone wants to grow their money, but not all have the ability to do it, and also many of us not be aware of how to do it. Taking a financial decision on investing your hard-earned money is not an easy task. This is where ETMONEY comes into the picture and it is one of the best apps for all your financial needs, but how? Let’s find out.

Many of us think that there is a major risk in investing money and hence keep them idle in banking, which gets you the least growth of 2-3% per year. With ETMONEY you can get rid of this problem as it offers a wide range of options for investing your money and growing it.

There are many investment options available and we broadly grouped them into three main options.

- Mutual funds

- Fixed Deposits

- NPS (National Pension System)

INVESTMENTS:

1. Mutual Funds:

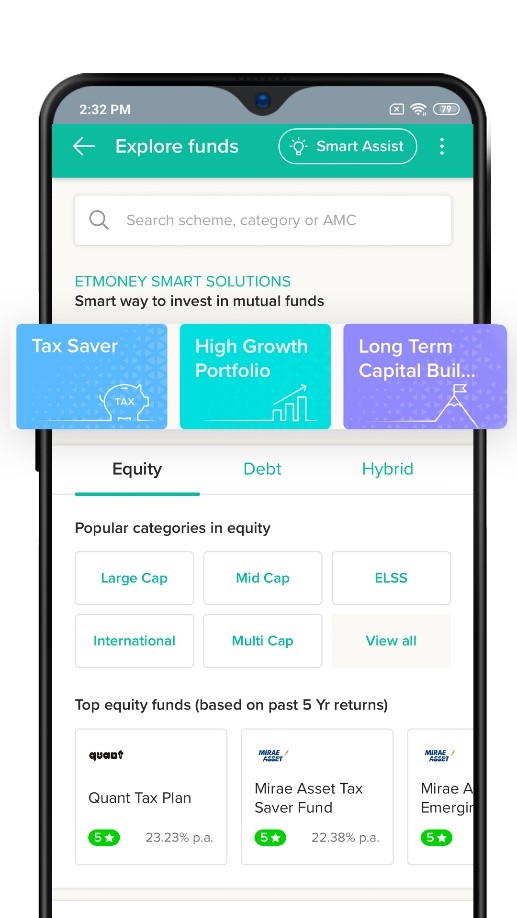

Mutual funds are the best options if you want to grow your income and ETMONEY offers the best options. With ETMONEY, investing in a Mutual fund is easy and it is paperless and also provided instant KYC. With ETMONEY, you invest in zero commission direct mutual funds.

The app also helps customers in finding the right funds for them. This is done in multiple ways.

One of the options is to go with smart solutions. These are baskets of hand-picked funds which are built for different goals. So you need to decide what you need to invest in and choose the smart solution.

The second option ETMONEY gives is to answer two simple questions to get the fund recommendation. The first question is how long you want to invest for and the second is around the risk you are willing to take. Once you answer them, you see a list of Smart Solutions and funds matching your need.

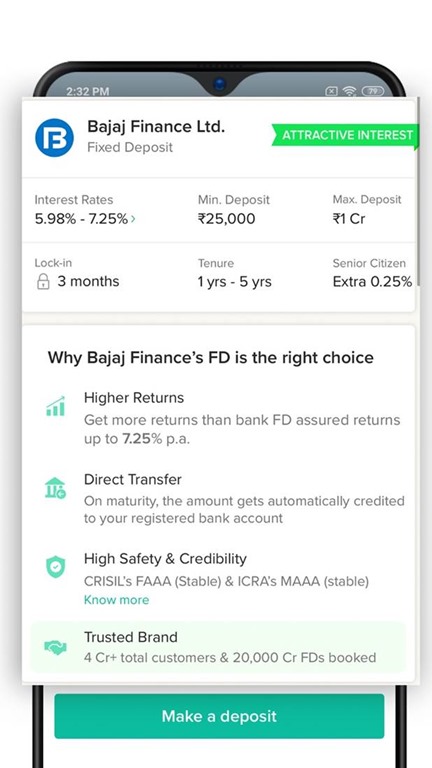

2. Fixed Deposits:

Fixed deposits are another way of growing your money and with guaranteed returns of up to 7.25% per annum, it is a good way to invest. Fixed Deposits give you assured returns, surety at maturity, and faster growth with compound interest.

ETMONEY offers fixed deposits with Bajaj Finance Ltd, which is a trusted brand with more than 4 crores customers. You get more returns than bank FD. There is also a direct transfer to your bank account on maturity. The app allows you to calculate the amount you will get based on parameters like deposit amount and deposit tenure. This helps in deciding the amount you want to invest in FD.

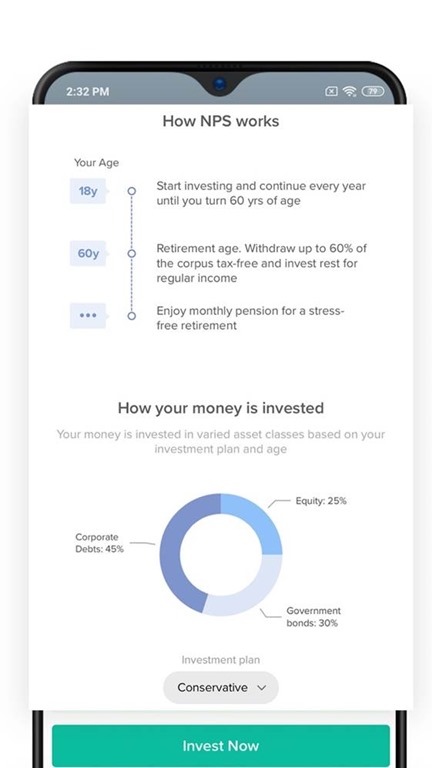

3. National Pension System (NPS)

NPS as the name indicates is the one to secure your retirement in the form of pensions. It gives you better returns compared to the traditional plans as it is a mix of stocks and FD-like investments. The contributions made towards NPS also help you save tax under 80C.

With ETMONEY, you can also invest in NPS every month by starting a SIP. Just With ETMONEY, it is fast, easy, and also paperless work. The app also offers an NPS calculator, which allows you to decide the investment you need to make for a proper pension at a later stage.

Tracking Investments:

This feature allows customers to bring in all their investments under one platform. Even if you have not done your investment using ETMONEY, you can bring it into the app which makes it easy to track from one platform or app.

Hassle-Free KYC:

For all the investments, the KYC is mandatory and ETMONEY offers the best possible experience with KYC. The process takes only a few minutes and can be done easily from your smartphone.

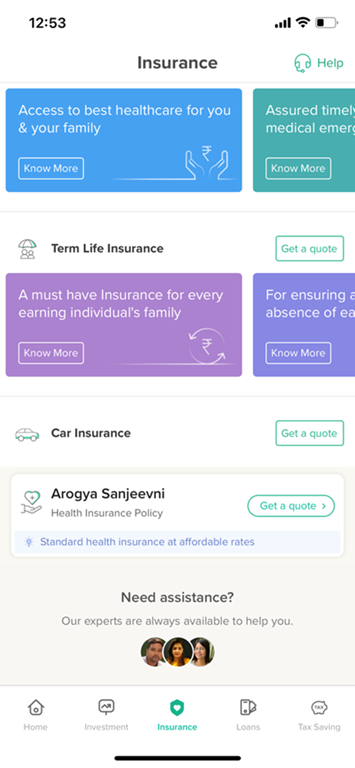

INSURANCE:

Buying insurance is a big task as there are many providers and you often get confused about what all features these providers offer. This is the same case when you want to buy car insurance, life insurance, or health insurance.

ETMONEY has tried removing this confusion. They ask you a few questions and based on your answers show the 2-3 plans best suited for you. ETMONEY allows you to compare and buy the best plans for you, your family, or even your parents. This is the same case with car insurance or term insurance.

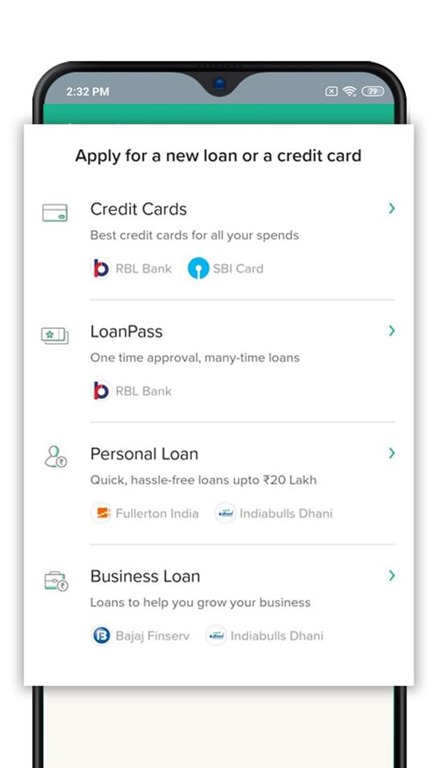

LOANS AND CREDIT CARDS

ETMONEY has LoanPass, which allows customers to borrow as low as Rs 3000 to Rs 5 Lakhs as many times as they want with just one-time approval. LoanPass is provided in collaboration with RBL bank.

You can also apply for a hassle-free personal loan or business loan using the ETMONEY app as well.

You can also apply for a credit card using the app. They have neatly classified cards based on spending so you can pick up a card that gives you the maximum rewards for a particular spending category. You can also compare different credit cards for their features and benefits using the app.

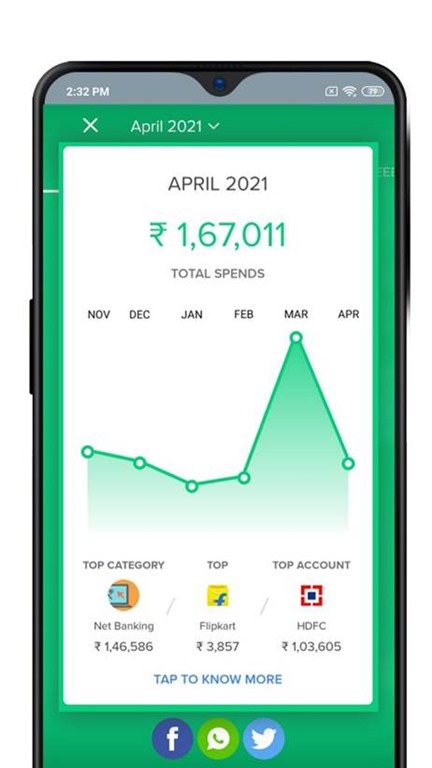

SPEND TRACKING:

ETMONEY also offers free Spends Tracker and Monthly Saver which automatically checks your spending using the messages you receive and then categorizes them and lets you know where you spend your money. You also get a weekly and monthly summary of all your spending. This feature is limited to Android phones and does not work on iOS due to OS limitations.

Looking at these features, without doubt, ETMONEY is the best all-in-one app for all your financial needs and it is also one of the most downloaded apps in India. ETMONEY is available for Android as well as iOS and you can download it from the links below.

Download the ET Money App from here.